Auto-regressive models for time series prediction

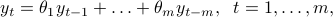

A popular model for the prediction of time series is based on the so-called auto-regressive (AR) model

where  's are constant coefficients, and

's are constant coefficients, and  is the memory length of the model. The interpretation of the model is that the next output is a linear function of the past. Elaborate variants of auto-regressive models are widely used for prediction of time series arising in finance and economics.

is the memory length of the model. The interpretation of the model is that the next output is a linear function of the past. Elaborate variants of auto-regressive models are widely used for prediction of time series arising in finance and economics.

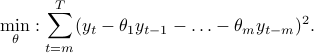

To find the coefficient vector theta in  , we collect observations

, we collect observations  (with

(with  ) of the time series, and try to minimize the total squared error in the above equation:

) of the time series, and try to minimize the total squared error in the above equation:

This can be expressed as a linear least-squares problem, with appropriate data  .

.

See also: Linear regression via Least-Squares.