Rate of return of a financial portfolio

Rate of return of a single asset

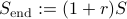

The rate of return  (or, return) of a financial asset over a given period (say, a year, or a day) is the interest obtained at the end of the period by investing in it. In other words, if, at the beginning of the period, we invest a sum

(or, return) of a financial asset over a given period (say, a year, or a day) is the interest obtained at the end of the period by investing in it. In other words, if, at the beginning of the period, we invest a sum  in the asset, we will earn

in the asset, we will earn  at the end. That is:

at the end. That is:

Log-returns

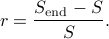

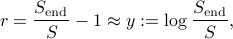

Often, the rates of return are approximated, especially if the period length is small. If  , then

, then

with the latter quantity known as log-return.

Rate of return of a portfolio

For  assets, we can define the vector

assets, we can define the vector  , with

, with  the rate of return of the

the rate of return of the  -th asset.

-th asset.

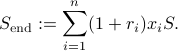

Assume that at the beginning of the period, we invest a sum  in all the assets, allocating a fraction

in all the assets, allocating a fraction  (in

(in  ) in the

) in the  -th asset. Here

-th asset. Here  is a non-negative vector which sums to one. Then the portfolio we constituted this way will earn

is a non-negative vector which sums to one. Then the portfolio we constituted this way will earn

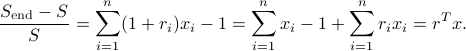

The rate of return of the porfolio is the relative increase in wealth:

The rate of return is thus the scalar product between the vector of individual returns  and of the portfolio allocation weights

and of the portfolio allocation weights  .

.

Note that, in practice, rates of return are never known in advance, and they can be negative (although, by construction, they are never less than  ).

).